The US dollar’s dominance as the world’s reserve currency isn’t ending anytime soon, according to a Carson Group investment research note. Reports of China’s yuan beating the USD as Russia’s most traded currency have fueled speculation that the currency king is about to lose power. This is reinforced by the recent agreement between China and Russia, as well as the rising tension between the two countries and the US. However, Carson Group strategist Sonu Varghese said there was no risk that the US dollar’s role in the global economy would end. Here are 3 reasons why the US dollar will remain resilient despite ongoing threats from global currencies. The world has confidence in the US and the USD

The US has the most liquid financial markets in the world due to its size and economic strength as well as practiced open trade and large capital flows. Although the US accounts for only about 25% of the world economy, but about 60% of global foreign currency reserves are denominated in USD. This is significantly greater than the euro (21%), the yen (6%) and the pound (5%).

The US dollar is dominant in international trade and finance

USD is the world’s most popular medium of exchange in the trade sector. Outside of Europe, where the euro is naturally dominant, more than 70 exports are invoiced in US dollars. It’s unlikely to change anytime soon because there are so many countries and companies involved.

The US is willing to maintain a large trade deficit

American imports amount to $3.3 trillion and exports to $2.1 trillion in 2022. This shows the large trade deficit borne by the US. But the US maintains it to give outsiders who hold US dollars the opportunity to put them elsewhere. For example, outsiders will look for opportunities to buy the safest and most liquid assets in the world such as US bonds.

The global economic model may take time to change, and it won’t happen anytime soon. Therefore, the dominance of the USD is seen not to be challenged due to current factors.

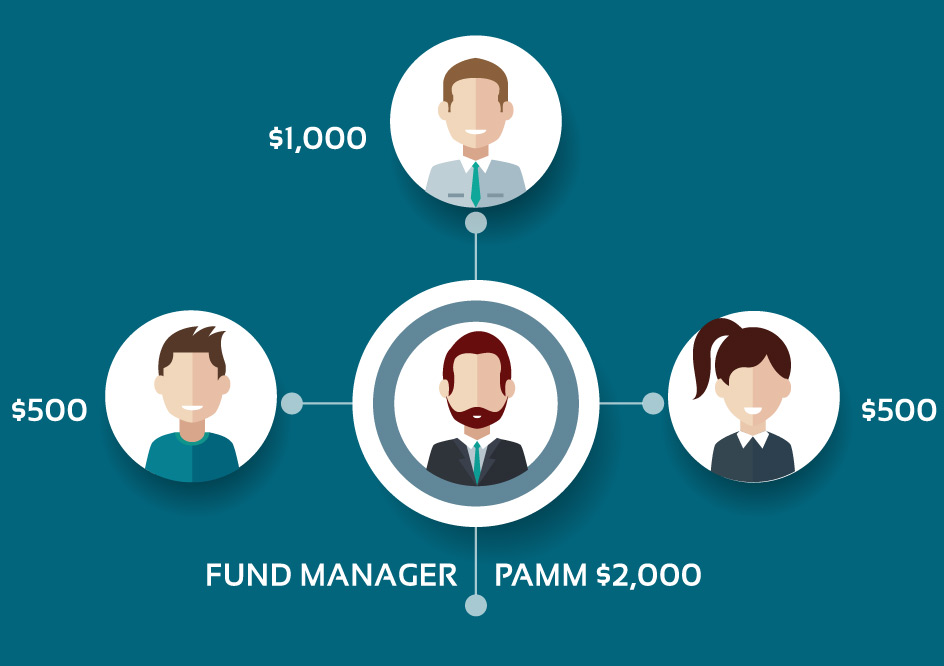

Register your Lirunex PAMM Account today with Ajmal Idlan! Fill in the details and we will contact you!