Trump Imposes 25 Percent Tariff on Malaysian Goods, Urges Firms to Build in America

In a move that shook global markets this week, former United States President Donald Trump made headlines once again by announcing a 25 percent tariff on selected Malaysian goods. This announcement, which came during a campaign rally in Ohio, was paired with a strong statement: “Build in America, not in Malaysia.”

This bold message triggered immediate reactions from investors, exporters, and political analysts. The market responded with a wave of volatility, especially in sectors related to electronics, manufacturing, and commodities.

What Is the Tariff About?

The new tariff targets a range of Malaysian exports including:

Semiconductors

Consumer electronics

Rubber-based products

Processed palm oil goods

According to Trump, this move is designed to “bring back American jobs” and “reduce reliance on cheap foreign production.” He framed the decision as part of his long-standing plan to reshape global trade to favor the American middle class.

Why Is Malaysia Affected?

Malaysia is one of the world’s largest exporters of electronics and palm oil products. The country has benefited from trade partnerships with the United States for decades. However, under Trump’s protectionist views, countries like Malaysia are seen as competitors, not partners.

By targeting Malaysia, Trump is sending a message not just to Asia, but to the world — America First is back on the table.

Immediate Market Reactions

As expected, the announcement triggered instant volatility:

The Malaysian Ringgit weakened slightly against the US Dollar.

Local stock counters related to tech and exports saw increased selling pressure.

Risk-off sentiment spread across Asian markets.

Forex traders saw the USD/MYR pair gaining strength, and gold surged momentarily as a safe haven response. This is another clear example of how geopolitical announcements can move the market within minutes.

Sources and Global Reactions

Major media outlets including Bloomberg, Reuters, and The Wall Street Journal have covered the announcement in detail.

In Malaysia, both MITI (Ministry of International Trade and Industry) and Bank Negara Malaysia are currently reviewing the full implications. Analysts believe the tariffs will likely affect over RM8 billion worth of annual trade between the two countries.

What This Means for Malaysian Traders and Investors

For Malaysian traders, especially those in forex and commodities, this move is a major signal. It shows how macroeconomics and politics can influence currency values and market sentiment.

Here is how I view this situation as a fund manager:

USDMYR may continue to strengthen if political tensions escalate further.

Export-based stocks may remain under pressure, especially in the tech and rubber industries.

Opportunities will arise in volatility, especially if you trade with the right strategy.

Final Thoughts from Ajmal Idlan

“This is a reminder that the market is not just moved by charts and candles. Real money moves when politics and economics collide. As a trader, your job is not to panic but to read between the lines.”

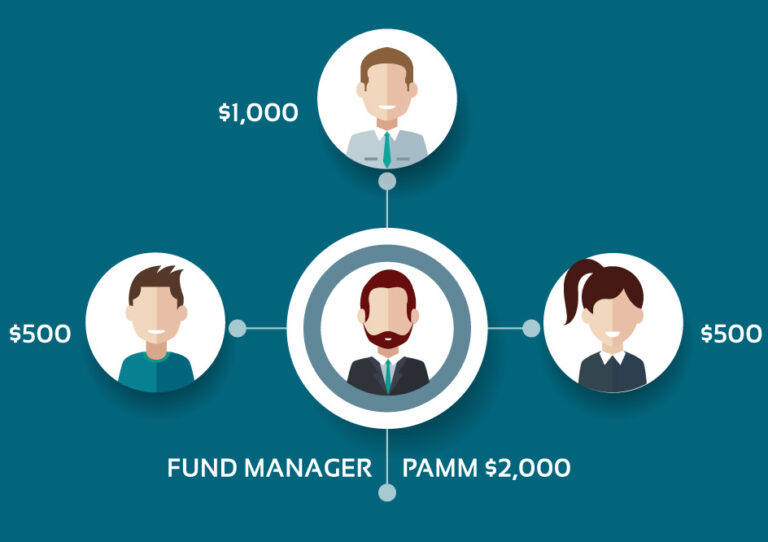

Whether you are investing in forex, stocks, or managing a fund like PAMM, your edge comes from being aware of the bigger picture. And right now, the picture is shifting fast.

📈 Want a strategy that adapts to real-time events?

💼 Join my PAMM service or get coached directly

🌐 Visit my site

📩 WhatsApp: 018-2030547

📢 Telegram: t.me/ajmalidlan