Percentage Allocation Management Module (PAMM) by Ajmal Idlan

Are you tired of facing losses in Forex while trading alone?

Looking for a profitable Forex investment opportunity but don't have the time or expertise to trade yourself? Let me be your guide!

As an experienced fund manager with successful PAMM accounts at top brokers like Lirunex, Startrader, and Ultima Markets, I offer you the unique chance to benefit from my expertise in PAMM fund management.

What is Percentage Allocation Management Module (PAMM)

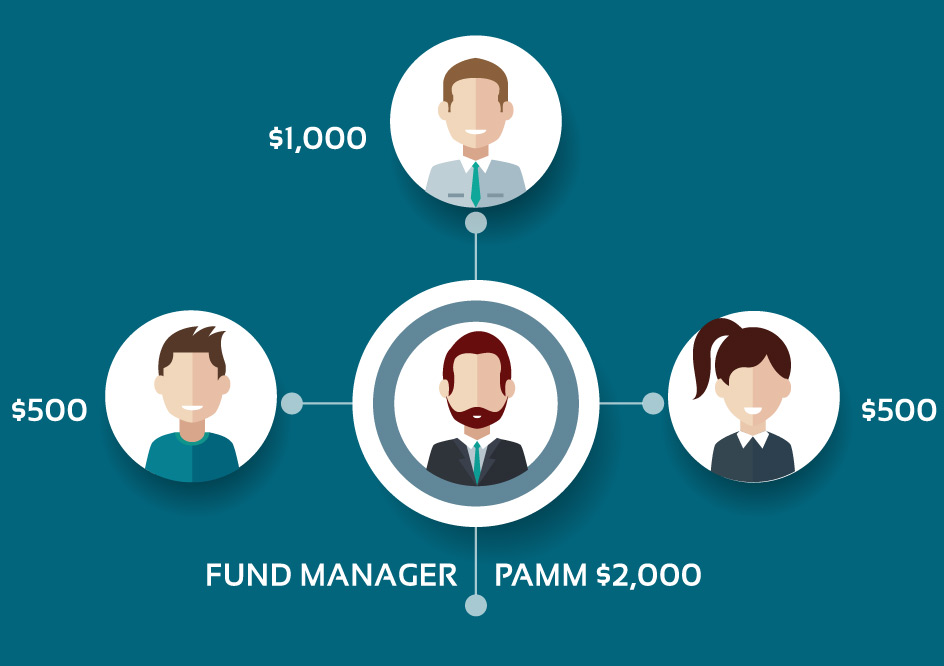

Account pool, also known as a PAMM (Percentage Allocation Management Module) account, is a type of forex trading account that allows multiple investors to pool their funds together and trade them under the control of a single trader. The trader’s profits are then distributed to the investors in proportion to their investment.

PAMM (Percentage Allocation Management Module) accounts have gained popularity in the financial markets as an investment model that allows individuals to allocate their funds to professional traders or money managers. If you’re interested in exploring the world of PAMM accounts, this comprehensive guide will provide you with a solid understanding of how they work and the key factors to consider. Additionally, we will introduce Lirunex, a reputable company that offers reliable PAMM account services.

Click here to read more about PAMM Services and FAQ Section

Why Choose Ajmal Idlan as your PAMM master?

Expert Management for Reliable Results

- Professional Expertise: Decades of Forex trading experience at your service.

- Solid Track Record: Consistently strong returns for our investors.

- Strategic Trading: Tailored strategies for diverse market opportunities.

- Market Variety: Broad exposure to various currencies.

- Insightful Analysis: Continuous market research for informed trading.

Transparency & Client-Centric Approach

- Clear Communication: Full transparency in all operations and results.

- Dedicated to You: Your financial success is our primary goal.

- Supportive Team: Always available for assistance and advice.

- Regular Updates: Frequent, detailed reports on your investments.

- Community Connections: Engage with an investor network for shared growth.

Focused on Risk Management & Ease

- Capital Safety: Prioritizing the protection of your investments.

- User-Friendly Processes: Easy and clear procedures for joining or exiting.

- Real-Time Access: Up-to-date information on your investment status.

- Fair Fees: Our success aligns with your profitable returns.

- Flexible Options: Investment choices that cater to your preferences.

Track my Performance

Track my profit journey through MyFxBook! Click the link below to open using myfxbook.com

Do you need a review? We got your back!

Register your Lirunex PAMM Account today with Ajmal Idlan! Fill in the details and we will contact you!

Frequently Asked Question

PAMM accounts are investment vehicles that allow individuals (investors) to allocate their funds to professional traders or money managers (money managers) who make trading decisions on their behalf. The allocation is done based on a percentage of the total funds in the PAMM account, and the profits or losses are distributed proportionally among the investors.

Investors open a PAMM account with a broker that offers PAMM services. They allocate their desired investment amount to a specific money manager, who then trades on their behalf using their expertise and strategies. The profits and losses generated from the trades are allocated among the investors based on their percentage of the total funds in the PAMM account.

- Professional Management: PAMM accounts provide access to the skills and expertise of professional money managers, allowing investors to benefit from their trading knowledge and experience.

- Diversification: By investing in a PAMM account, investors can gain exposure to a diversified portfolio of trading strategies and instruments, which can help reduce risk.

- Passive Income Generation: Investors can potentially earn passive income from their investments in PAMM accounts without actively participating in trading activities.

- Transparency: PAMM accounts offer transparency, allowing investors to monitor the performance of the account, review trading activities, and make informed investment decisions

How We Share Profits in Our PAMM Accounts

Here’s a quick and easy guide on how we split profits between our investors (like you!) and me, the fund manager.

Simple Steps of Profit Sharing:

1. Trading:

💎We use pooled money from all Investors to trade in Forex Market and aim to make profits.

2. Counting Our Winning Profit:

💎After profit is secured, we calculate how much profit we made. We make sure to take out any costs from trading first.

3. Sharing the Profit:

💎 We split the profits: 60% goes to investors and 40% to me, the fund manager.

What This Means for You?

The distribution of profits is proportional to their respective investments. Here’s how it works:

💵 Let’s say we made a $10,000 profit.

1. Total Profit Distribution = 40% for Ajmal, 60% for Investor

60% of $10,000 = $6,000 and allocated to the investors.

2. Determining Each Investor’s Share:

💵 Each investor’s share in the PAMM account is calculated based on the amount they invested relative to the total pooled investment. The more you deposit, the more return you get.

4. Example of Calculation:

We have 3 investors:

Investor A – $5,000,

Investor B – $15,000,

Investor C – $30,000.

Total Account (A + B + C) = $50,000.

Investor A’s share: $5,000 / $50,000 = 10%

Investor B’s share: $15,000 / $50,000 = 30%

Investor C’s share: $30,000 / $50,000 = 60%

If the profit is $6,000,

Investor A receives 10% of $6,000 = $600

Investor B receives 30% of $6,000 = $1,800

Investor C receives 60% of $6,000 = $3,600

This proportional distribution ensures that each investor receives a return that accurately reflects the size of their investment in the PAMM account. It’s a fair system that rewards investors according to their stake in the pool.

Why It Works Well:

Fair and Clear: We agree on this split right from the start. No hidden surprises!

Win-Win: If you make money, I make money. We’re in this together!

Choices for You: You can decide to reinvest your profits or take them out. It’s all up to you!

Remember:

Trading has risks, and profits can’t be guaranteed, but I work hard to make the best trading decisions for us.

At Ajmal Idlan, we value your trust and aim to make Forex trading simple and rewarding for you. Let’s grow your investment together!

Yes, PAMM accounts are legal in most countries; however, their safety can vary depending on several factors.

To ensure a secure investment experience, it is crucial to select a reputable and regulated forex broker that offers PAMM services. By doing so, investors can mitigate potential risks associated with PAMM accounts and enjoy the benefits of professional money management.