In the fast-paced world of financial markets, the choice between day trading and swing trading can significantly impact not just your portfolio but also your lifestyle. These two popular trading strategies cater to different preferences, time commitments, and risk tolerances. Understanding the nuances of day trading and swing trading is crucial for aligning your chosen strategy with your unique lifestyle and financial goals.

Day Trading: Seizing Opportunities in Real-Time

Day trading involves making multiple trades within a single day, capitalizing on short-term price movements. This strategy demands active and continuous involvement in the market, requiring traders to closely monitor charts, news, and technical indicators throughout the trading day. Day traders aim to profit from intraday fluctuations, entering and exiting positions swiftly.

Pros of Day Trading:

- Quick Returns: Day traders seek to capitalize on intraday price movements, potentially generating quick profits.

- No Overnight Risk: Day traders typically close all positions by the end of the trading day, eliminating the risk of overnight market changes affecting their portfolio.

Cons of Day Trading:

- Time-Intensive: Requires constant attention to the markets, making it challenging for those with busy schedules.

- High Stress: Rapid decision-making and real-time market analysis can lead to increased stress levels.

Swing Trading: Riding the Market Waves

Swing trading, on the other hand, involves holding positions for a few days to weeks, capturing ‘swings’ in the market. This strategy allows for a more relaxed approach, as traders do not need to monitor the markets constantly. Swing traders aim to capture price movements within the broader trend, leveraging technical analysis to identify potential entry and exit points.

Pros of Swing Trading:

- Flexible Time Commitment: Allows for a more flexible schedule, making it suitable for those with other commitments.

- Reduced Stress: Not as time-sensitive as day trading, providing traders with a more relaxed trading experience.

Cons of Swing Trading:

- Overnight Risk: Positions are typically held overnight, exposing traders to potential market gaps and changes in sentiment.

- Delayed Returns: Profits may take longer to materialize compared to day trading.

Choosing the Right Fit for You:

The decision between day trading and swing trading ultimately boils down to your lifestyle, risk tolerance, and personal preferences. If you thrive in a fast-paced environment, have the time to dedicate to constant market monitoring, and can handle the associated stress, day trading might be a suitable option. On the other hand, if you prefer a more relaxed approach, have other commitments, and are comfortable with holding positions overnight, swing trading could align better with your lifestyle.

Conclusion:

Day trading and swing trading each offer unique opportunities and challenges. Successful trading requires a deep understanding of your own lifestyle, risk tolerance, and financial goals. Whether you choose to ride the waves with swing trading or dive into the fast-paced world of day trading, finding the right strategy is key to navigating the financial markets with confidence and success.

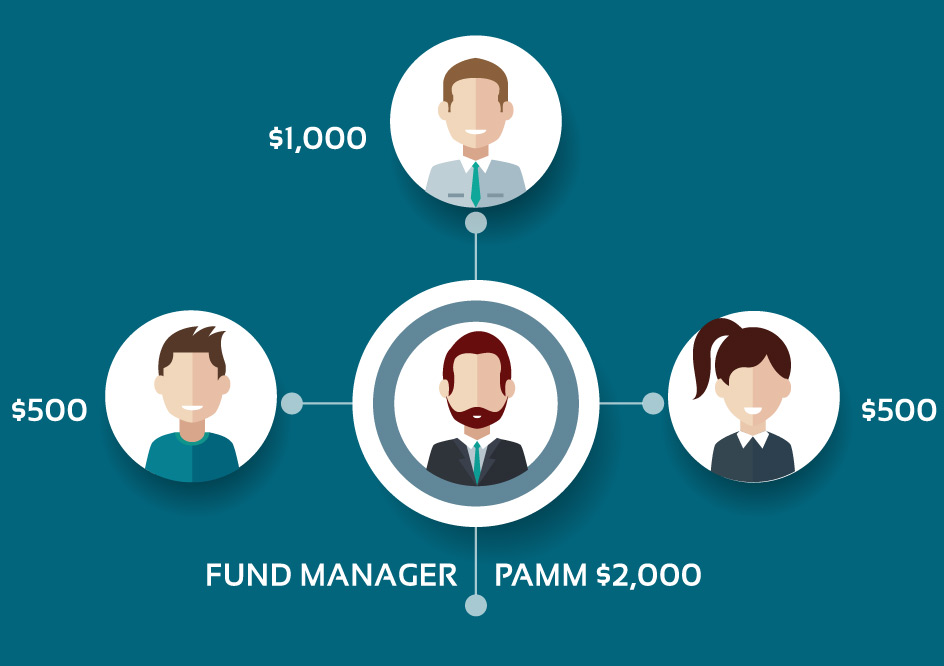

Register your Lirunex PAMM Account today with Ajmal Idlan! Fill in the details and we will contact you!