Profitable GBPCHF Buy Positions: My Analysis and Trade Breakdown

This week, I managed to secure multiple winning positions on GBPCHF, all from the same side — buy entries only. It was not luck, but structure. I followed my analysis, trusted my levels, and stayed disciplined throughout the setup.

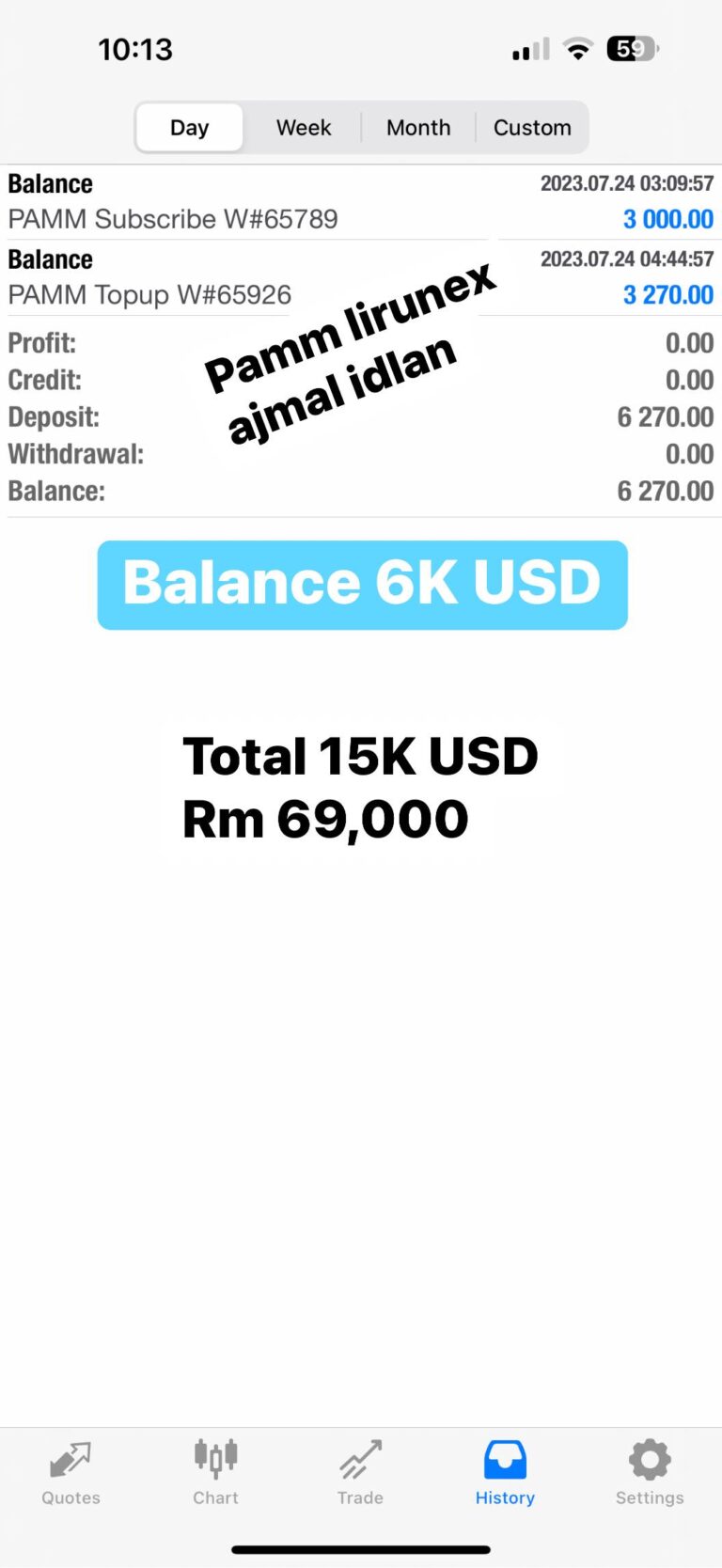

In this article, I will share how I saw the opportunity on GBPCHF, how I executed the trades, and why this kind of structured approach helps grow the PAMM account consistently.

Why GBPCHF Was a Buy This Week

When I looked at GBPCHF earlier in the week, the structure was clear.

-

Daily chart showed strong support holding near 1.2100

-

Price action was forming higher lows, signalling bullish pressure

-

GBP sentiment was supported by stronger UK data and expectations of rate stability

-

CHF weakness across the board created a bullish bias on CHF pairs

The combination of these factors told me that GBPCHF was gearing up for a bullish move. What I needed was the right confirmation and timing.

The Trade Setup I Used

I entered multiple buy positions on GBPCHF as the market gave me:

-

A clean break of minor resistance at 1.2160

-

A successful retest of the breakout level

-

Bullish candlestick confirmations on lower timeframes (M15 and H1)

Each entry was calculated with proper lot sizing and risk management, using the same strategy I apply in my PAMM trading.

How I Managed the Trades

Once in the position:

-

I moved stop loss to breakeven once the price moved 20 pips in profit

-

I secured partial profit at the next key resistance level

-

I let the rest run with trailing stop to capture more upside

This is the kind of disciplined management that allows me to profit multiple times, even from one single setup. No guesswork — just execution based on a plan.

Ajmal’s View on Market Right Now

GBPCHF is still in a bullish trend overall, but traders need to be selective. Do not chase the market. Wait for price to return to key zones before jumping in.

Right now, I am eyeing a potential pullback near 1.2220 for the next opportunity. If price holds that level and forms support, the next upside target could be 1.2300.

But remember — structure first, signal second, and emotion never.

Want to Follow These Kinds of Trades?

If you are tired of inconsistent trades and emotional entries, I invite you to follow my trading journey in the PAMM service.

You do not need to trade alone. Let me manage the risk and execution while you watch your capital grow in a structured, professional system.