Economic recessions are challenging times that can have a profound impact on global financial markets, including the foreign exchange (Forex) market. A recession is a period characterized by a significant decline in economic activity, typically marked by falling GDP, rising unemployment rates, reduced consumer spending, and overall economic uncertainty. During such times, Forex traders face unique challenges and opportunities.

In this comprehensive guide, we will explore the intricacies of trading Forex during economic recessions, covering key topics such as what a recession is, the behavior of the Forex market during recessions, currencies with poor and strong performance, and strategies for successful Forex trading during these trying times.

1. What Is a Recession?

A recession is a macroeconomic condition characterized by a sustained period of economic decline. While the exact definition may vary, common indicators of a recession include:

- Contractions in GDP (Gross Domestic Product): When a country’s GDP declines for two consecutive quarters, it is often considered a clear sign of a recession.

- Rising Unemployment: High unemployment rates are a hallmark of a recession, as businesses tend to cut jobs during economic downturns.

- Reduced Consumer Spending: Consumer spending typically decreases as people become more cautious about their finances during a recession.

- Declining Industrial Production: Industrial output and manufacturing often decline, reflecting reduced demand for goods.

- Increased Business Failures: Many businesses struggle to survive during recessions, leading to bankruptcies and closures.

Recessions can result from various factors, such as financial crises, high inflation, or external shocks like the COVID-19 pandemic. They are often followed by government intervention and stimulus measures to stimulate economic recovery.

2. Forex Market During a Recession

The Forex market is known for its resilience and adaptability to changing economic conditions. However, during a recession, it exhibits distinct characteristics that traders should be aware of:

- Increased Volatility: Economic uncertainty and risk aversion can lead to higher volatility in the Forex market. Traders may experience larger price swings and sudden market moves.

- Flight to Safe Havens: In times of economic uncertainty, investors often seek safe-haven assets, including currencies like the US Dollar (USD), Swiss Franc (CHF), and Japanese Yen (JPY). These currencies tend to strengthen during recessions.

- Commodity Currency Weakness: Currencies tied to commodity exports, such as the Australian Dollar (AUD) and Canadian Dollar (CAD), can weaken during recessions due to reduced demand for commodities.

- Central Bank Actions: Central banks often respond to recessions by implementing monetary policy measures, such as interest rate cuts and quantitative easing. These actions can influence currency values.

- Economic Data Impact: Traders pay close attention to economic indicators like employment reports, GDP figures, and consumer sentiment during recessions, as they can significantly affect currency movements.

3. Currencies with Poor Performance During a Recession

During economic recessions, certain currencies tend to underperform due to various factors. Traders should exercise caution when trading these currencies:

3.1 Commodity-Linked Currencies

- Australian Dollar (AUD): Australia’s economy heavily relies on commodity exports, particularly minerals and energy resources. Reduced global demand for these commodities during a recession can weaken the AUD.

- Canadian Dollar (CAD): Similarly, Canada’s economy is closely tied to commodities, particularly oil. Lower oil prices and decreased demand can lead to CAD depreciation.

3.2 Emerging Market Currencies

Emerging market currencies, including the Turkish Lira (TRY) and South African Rand (ZAR), often suffer during recessions due to their higher risk profile. Investors tend to seek safer assets during economic uncertainty, causing capital flight from these currencies.

3.3 European Currencies

Euro (EUR): The Eurozone, consisting of multiple European countries, can experience economic disparities during a recession. The Euro’s performance may be influenced by the financial health of its member states.

4. Currencies with Good Performance During a Recession

During economic recessions, certain currencies tend to perform well as investors seek safe havens and stability. These currencies include:

4.1 US Dollar (USD)

The US Dollar is considered one of the primary safe-haven currencies. During recessions, investors often flock to the USD due to its status as the world’s primary reserve currency and the relative stability of the US economy.

4.2 Swiss Franc (CHF):

The Swiss Franc is another popular safe-haven currency. Switzerland’s strong financial sector, stable economy, and low inflation make the CHF an attractive choice for risk-averse investors.

4.3 Japanese Yen (JPY):

The Japanese Yen is known for its low-interest rates and safe-haven status. During recessions, the JPY can appreciate as investors seek safety and liquidity.

4.4 Gold (XAU):

While not a currency in the traditional sense, gold often behaves as a safe-haven asset during economic crises. Its value tends to rise as investors seek refuge from volatile markets.

5. How to Trade Forex During a Recession

Trading Forex during a recession requires a thoughtful approach and adherence to sound strategies. Here are key tips for navigating the Forex market successfully during economic downturns:

5.1 Risk Management

- Prioritize risk management to protect your capital. Use stop-loss orders and set appropriate risk-reward ratios for your trades.

- Diversify your portfolio by trading a mix of currency pairs. This reduces exposure to the poor-performing currencies mentioned earlier.

5.2 Fundamental Analysis

- Stay informed about economic indicators and central bank policies. Pay close attention to news releases related to GDP, employment, inflation, and interest rates.

- Monitor sentiment indicators like consumer confidence and investor sentiment, as they can provide insight into market direction.

5.3 Technical Analysis

- Utilize technical analysis to identify key support and resistance levels, trendlines, and chart patterns. These tools can help you make informed trading decisions.

- Be cautious of extreme market volatility and use appropriate timeframes for your analysis.

5.4 Safe-Haven Currencies

- Consider trading safe-haven currencies like the USD, CHF, and JPY during recessions. These currencies often exhibit strength and stability.

- Pair safe-haven currencies against weaker currencies for potential trading opportunities.

5.5 Watch for Central Bank Actions

Keep an eye on central bank announcements and monetary policy decisions. Central banks may take measures like interest rate cuts or quantitative easing, which can impact currency values.

5.6 Stay Informed and Adapt

Be adaptable and willing to adjust your trading strategies as market conditions evolve. Economic recessions can be unpredictable, so staying informed is crucial.

In Summary

Trading Forex during economic recessions presents both challenges and opportunities. By understanding the behavior of the Forex market during recessions, recognizing which currencies tend to perform well or poorly, and implementing sound trading strategies, traders can navigate these turbulent times with greater confidence and success. Remember that proper risk management, continuous learning, and staying informed about economic indicators are essential components of successful Forex trading during economic downturns.

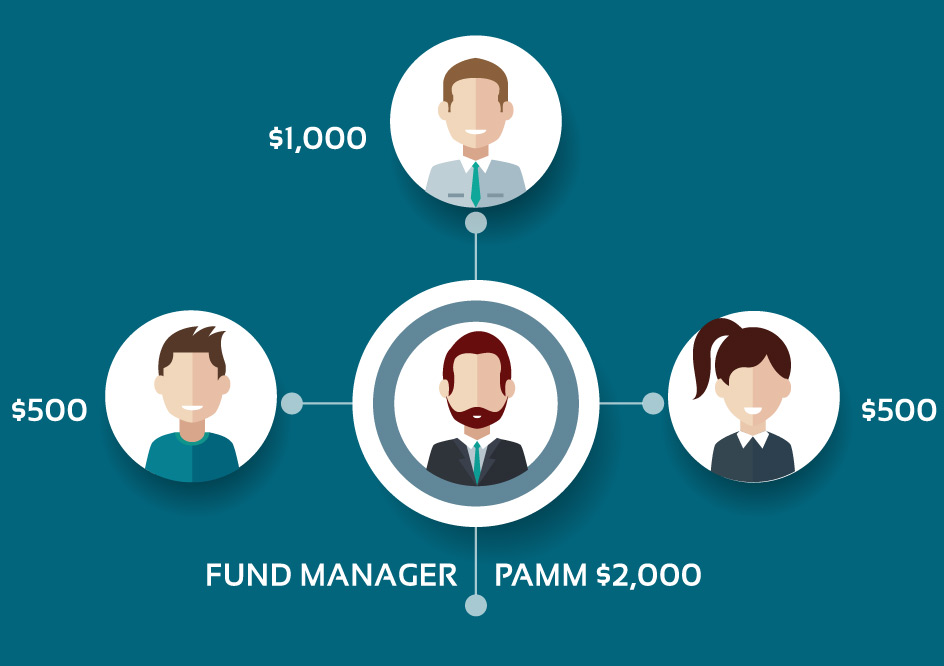

Register your Lirunex PAMM Account today with Ajmal Idlan! Fill in the details and we will contact you!