The value of the ringgit continued its decline which closed yesterday low against the US dollar at the time of the expected interest rate cut by the Federal Reserve in March. At exactly 10.30 this morning, the ringgit fell to 4.6900 compared to yesterday’s close at around 4.6677. Standard Chartered Bank expects the Fed to cut interest rates four times in 2024 totaling 100 basis points with inflation and geopolitics being key factors in the determination.

According to the Chief Economist of Bank Muamalat Malaysia, Afzanizam Rashid said the market is still adopting a ‘risk-off’ mode and this will lead to higher demand for the US dollar. Tensions in the Middle East, especially in the Red Sea, continue to be the main driver in putting pressure on the ringgit for the near future. Meanwhile, the data in focus this week is China’s fourth quarter 2023 economic growth release and US retail sales in December. For now, the USD/MYR pair will continue to hover around the RM4.66 to RM4.79 level while waiting for an important report tonight.

The ringgit once again opened lower compared to the world’s major currencies. It fell against the euro to 5.1189 and the British pound to 5.9489. The local currency is also still disappointing compared to the Asean currency group. It is lower against the Thai baht, the Singapore dollar and the Indonesian rupiah. The ringgit is also almost insignificant compared to the value of the Philippine peso.

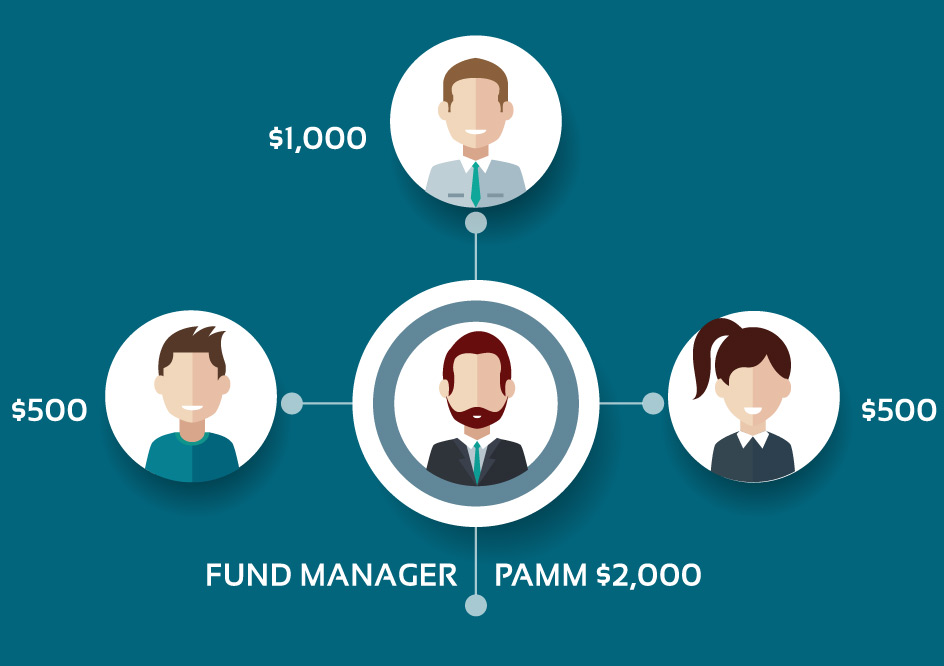

Register your Lirunex PAMM Account today with Ajmal Idlan! Fill in the details and we will contact you!