The Malaysian Ringgit (RM) opened slightly lower today due to investors awaiting the Bank Negara Malaysia (BNM) meeting in setting monetary policy as well as the announcement of the latest Overnight Policy Rate (OPR). At exactly 9am this morning, the ringgit opened low at 4.7270 against the US dollar from 4.7265 yesterday.

According to SPI Asset Management Director, Stephen Innes said the market expects BNM to set the interest rate at 3.0 percent in its next decision. Based on media reports, the Chinese government plans to inject 2 trillion yuan into its economy to boost market confidence and local investors. Indirectly, this will give Southeast Asian currencies an advantage to strengthen.

There are expectations that the ringgit will accelerate to beat other Asean currencies if China’s proposed stimulus plan is implemented. Meanwhile, the ringgit traded higher against a group of major currencies. It appreciated against the Japanese yen to 3.1900/1946 from 3.1994/2013, rose against the British pound to 5.9976/6.0059 from 6.0159/0191 and improved against the euro to 5.1293/13657 from 5.14857 at yesterday’s close. At the same time, local currencies are also traded mostly higher than Asean currencies. It rose slightly against the Singapore dollar to 3.5242/5293 from 3.5283/5304, rose against the Thai baht to 13.2106/2343 from 13.2395/2521 and rose against the Philippine peso at 8.39/8.41 from 8.41/8. However, it traded slightly lower against the Indonesian rupiah to 302.3/302.7.4 from 302.2/302.4 at yesterday’s close.

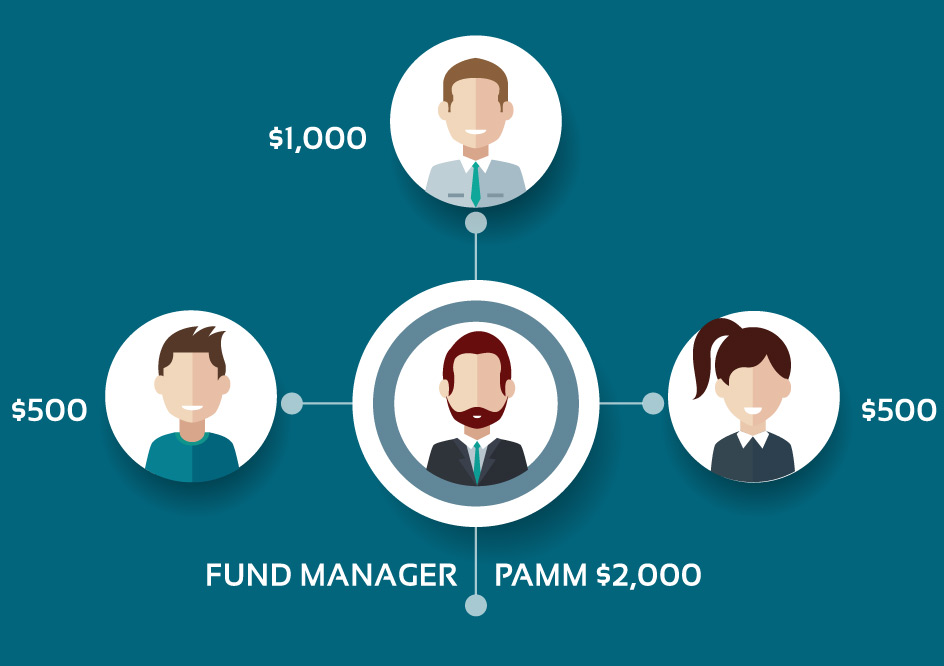

Register your Lirunex PAMM Account today with Ajmal Idlan! Fill in the details and we will contact you!