Introduction:

PAMM (Percentage Allocation Management Module) accounts have gained popularity in the financial markets as an investment model that allows individuals to allocate their funds to professional traders or money managers. If you’re interested in exploring the world of PAMM accounts, this comprehensive guide will provide you with a solid understanding of how they work and the key factors to consider. Additionally, we will introduce Lirunex, a reputable company that offers reliable PAMM account services.

1. What are PAMM Accounts?

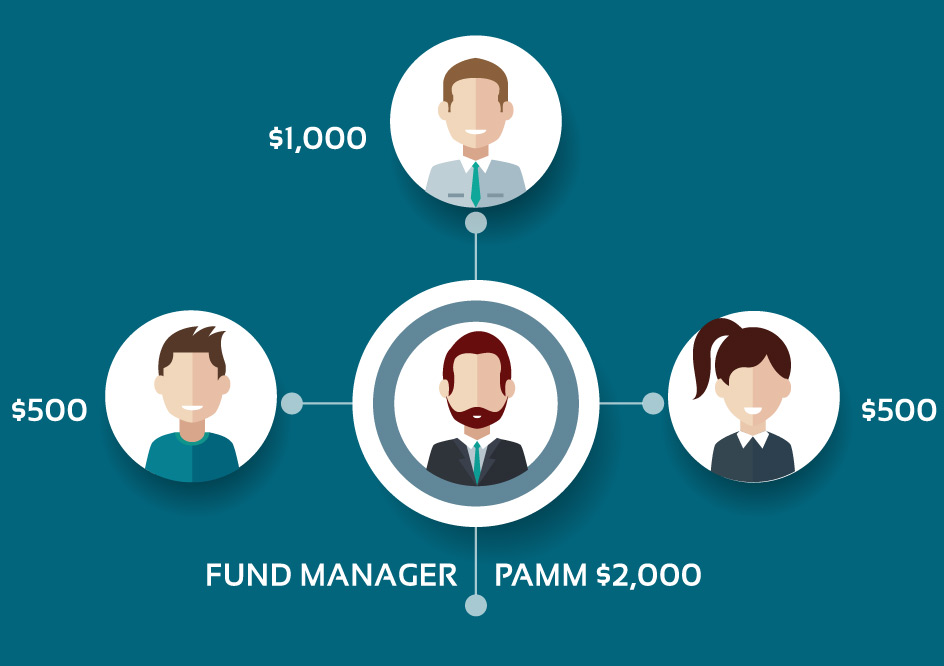

PAMM accounts are investment vehicles that allow individuals (investors) to allocate their funds to professional traders or money managers (money managers) who make trading decisions on their behalf. The allocation is done based on a percentage of the total funds in the PAMM account, and the profits or losses are distributed proportionally among the investors.

2. How do PAMM Accounts Work?

Investors open a PAMM account with a broker that offers PAMM services. They allocate their desired investment amount to a specific money manager, who then trades on their behalf using their expertise and strategies. The profits and losses generated from the trades are allocated among the investors based on their percentage of the total funds in the PAMM account.

3. Benefits of PAMM Accounts:

- Professional Management: PAMM accounts provide access to the skills and expertise of professional money managers, allowing investors to benefit from their trading knowledge and experience.

- Diversification: By investing in a PAMM account, investors can gain exposure to a diversified portfolio of trading strategies and instruments, which can help reduce risk.

- Passive Income Generation: Investors can potentially earn passive income from their investments in PAMM accounts without actively participating in trading activities.

- Transparency: PAMM accounts offer transparency, allowing investors to monitor the performance of the account, review trading activities, and make informed investment decisions

4. Key Considerations for Investors:

- Money Manager Evaluation: Investors should conduct thorough research on money managers, analyzing their track record, trading strategies, risk management practices, and performance history.

- Risk Management: Understanding the money manager’s approach to risk management is essential. Investors should assess how risks are controlled and what measures are in place to protect capital.

- Investment Amount and Duration: Investors should determine the appropriate investment amount and consider the duration of their investment in a PAMM account, aligning them with their financial goals and risk tolerance.

- Performance Monitoring: Regularly monitoring the performance of the PAMM account is crucial. Investors should review performance reports, assess profitability, and reassess their investment decisions when necessary

Conclusion:

PAMM accounts offer a convenient way for individuals to invest in the financial markets through professional money managers. Understanding the workings of PAMM accounts and considering key factors such as money manager evaluation, risk management, investment amount, and performance monitoring are essential for successful investing.

When exploring PAMM account services, Lirunex stands out as a reliable company that offers comprehensive PAMM services. With their commitment to transparency, skilled money managers, and reliable performance, Lirunex provides a trusted platform for investors seeking to leverage the potential of PAMM accounts.

By utilizing the information and guidelines provided in this guide, you can make informed decisions when venturing into the world of PAMM accounts. Choose wisely, consider the offerings of Lirunex, and embark on your investment journey with confidence.

Register your Lirunex PAMM Account today with Ajmal Idlan! Fill in the details and we will contact you!